Follow @infolibnews!function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0];if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src='//platform.twitter.com/widgets.js';fjs.parentNode.insertBefore(js,fjs);}}(document,'script','twitter-wjs');

by James E. Miller

Earlier this week, former U.S. president Bill Clinton gave the keynote address to the Democractic National Convention in an effort to lend some of his popularity to Barack Obama.? With the unemployment rate still stubbornly high at 8.1%, Obama has lost many of the enthused voters who put him into the Oval Office in 2008.? Clinton was tapped to deliver the speech not only because of his image of a wonkish pragmatist but because of his presiding over the booming economy of the late 1990s.? Like a prized mule, Clinton was dragged out to give Democrats someone to point to and say that his policies were the hallmark of smart governance.

Earlier this week, former U.S. president Bill Clinton gave the keynote address to the Democractic National Convention in an effort to lend some of his popularity to Barack Obama.? With the unemployment rate still stubbornly high at 8.1%, Obama has lost many of the enthused voters who put him into the Oval Office in 2008.? Clinton was tapped to deliver the speech not only because of his image of a wonkish pragmatist but because of his presiding over the booming economy of the late 1990s.? Like a prized mule, Clinton was dragged out to give Democrats someone to point to and say that his policies were the hallmark of smart governance. What attracts the left, both politicians and media, to Slick Willy is the fact that he presided over a thriving economy even while raising taxes.? This coincidence was championed as a justification for higher tax rates by Obama in his own speech before the DNC.

I want to reform the tax code so that it?s simple, fair, and asks the wealthiest households to pay higher taxes on incomes over $250,000 -- the same rate we had when Bill Clinton was president; the same rate we had when our economy created nearly 23 million new jobs, the biggest surplus in history, and a lot of millionaires to boot.The Clinton-era tax hikes, it is alleged, provided the federal government the means to create a healthy middle class.? Or at least that's the only casual connection that can be gathered from such a philosophy.? The left claims that economic growth is driven primarily by middle class spending.? This spending needs to be subsidized in turn by government initiatives.? As Nobel Prize winning economist and class warrior Joseph Stiglitz puts it:

Many at the bottom, or even in the middle, are not living up to their potential, because the rich, needing few public services and worried that a strong government might redistribute income, use their political influence to cut taxes and curtail government spending. This leads to underinvestment in infrastructure, education, and technology, impeding the engines of growth.Stiglitz's thinking rests on the Keynesian theory that economies are reliant on strong levels of consumption and demand.? And with the right people in office, the state is the most capable institution of spending a nation into prosperity.

However this is a misunderstanding of the difference between spending by private individuals and political spending.? Government is incapable of being run like a business.? Enterprise is based off the principle of satisfying voluntary patrons with no guarantee of success.? Even in a hampered market economy where corporations receive special privileges via the state, the consumer remains the kingmaker.? On the other hand, government receives all income through coercive measures.? Profit and loss accounting is of little concern when losses are borne by the taxpayer and profits are immediately devoted to political projects.? Should the public Treasury run low, tax collectors can be sent forth to shakedown the unpresuming citizens.

When it comes to rational economic calculation, public officials need not worry about spending money effectively. To attribute increased revenue being taxed away from the private economy with robust growth misconstrues how wealth is created.? Government doesn't create wealth; it merely transfers it between parties.? Similarly, it only consumes capital that has already been produced.? Because society existed before the state and because the state functions off of what it pilfers from society, public expenditures do not add to net wealth.? In order for one tax dollar to be spent, it has to be first taken from the pocket of a taxpayer.? Whatever subjective desires could have been achieved by that dollar become overridden to satisfy the whims of the political class.

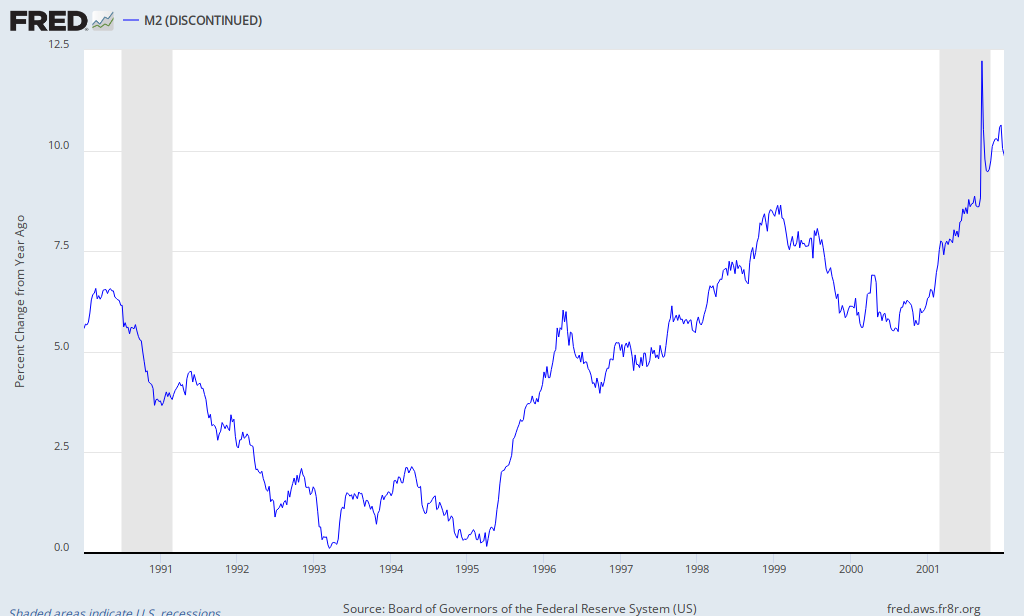

As journalist of the old right Garet Garrett wrote in his vital essay "The Revolution Was"

If you raise agricultural prices to increase the farmer?s income the wage earner has to pay more for food. If you raise wages to increase the wage earner?s income the farmer has to pay more for everything he buys. And if you raise farm prices and wages both it is again as it was before. Nevertheless, to win the adherence which is indispensable you have to promise to increase the income of the farmer without hurting the wage earner and to increase the wage earner?s income without hurting the farmer. The only solution so far has been one of acrobatics.The money distributed by politicians and bureaucrats is forever stained with previous sin.? The fact that the economy didn't stagnate under higher taxes during Clinton's term in office doesn't demonstrate that taxation has no harmful effects.? Economies aren't closed experiments where one variable can be introduced and the effects observed.? There are far too many factors at play.? Concrete theories based off certain truths must be applied in such a way to interpret date and wring sense out of it.? Good economic conditions weren't a result of heightened taxes but instead prevailed in spite of them.? While the productivity gains from the newly widespread use of personal computers and the internet had a positive effect on growth, another factor often goes unmentioned.? The later-half of the 1990s may be looked back upon as golden years but much of the gains experienced by the stock market were not representative of organic growth.? A significant amount of investment came not from natural causes but from monetary manipulation by the Federal Reserve.? See the following chart for the year-over-year percentage of growth of the M2 money supply.

As Pace University professor of economics Joseph Salerno writes:

In 1992 and 1993, the Fed gunned the money supply increasing it at double-digit annual rates in an attempt to propel the economy into a more expeditious recovery.? In 1994, the Fed reversed course and held the monetary growth rate at low levels through 1995.??In 1996 it did another about-face and substantially increased the pace of monetary inflation through 1999.??Just as the Austrian business cycle theory predicted, real private investment soared from a low of 12 percent of GDP in 1991 to an unprecedented high of 20 percent of GDP by mid-2000 with a pause in the tight money years 1994-1995.Like the decade that preceded the Great Depression, productivity gains which drove consumer prices downward masked the amount of monetary stimulus being pumped into the economy.? When the bubble collapsed, Greenspan once again turned to the printing press to bail himself out.? Instead of causing a bubble in the tech sector, the burst of inflation made its way into the housing sector.? By the time the housing bubble popped, Greenspan left the chairmanship of the Fed to great acclaim.? Milton Friedman writing in the Wall Street Journal declared Greenspan had "set the standard" for Fed chairmen in maintaining stable prices and growth.? In actuality, he and his colleagues of the Federal Open Market Committee were responsible for the continuation of the boom-bust cycle and current Great Recession."?like the stock bubble, the investment bubble was driven by monetary inflation and doomed to collapse whenever Greenspan decided that the economic data were signaling impending price inflation and slammed on the monetary brake.??This occurred last year (2000) when consumer price inflation shot up to nearly 4 percent per year and jolted Greenspan and the FOMC into raising short-term interest rates. Indeed the money supply actually shrunk by $20 billion and its annual rate of growth (year over year) plummeted from an average of 6.23 percent for the period1996-1999 to -1.24 percent in 2000.

This monetary tightening devastated the New Economy and the NASDAQ tanked, falling by over 50 percent from its high in March 2000.??But, even more importantly, it also brought the investment boom in the real sector of the economy to a screeching halt.

Today, Clinton still takes credit for Greenspan's manipulated boom.? His supporters on the left love nothing more than to point at his presidency as vindication of the backwards theory that higher taxes equal more growth.? Clinton wasn't a policy wonk; he was a politician who dipped into the Social Security trust fund to give an appearance of balancing the budget while the national debt still climbed higher.

Through all of his financial scandals, womanizing, aggressive foreign policy approaches, and possible cover ups, it is actually fitting that Clinton is still looked to by the political establishment as someone worthy of respect.? He is representative of F.A. Hayek's timeless lesson: in government the worst rise to the top and state power corrupts.

_

James E. Miller holds a BS in public administration with a minor in business from Shippensburg University, PA. He is the Editor in Chief at the Ludwig von Mises Institute of Canada and a current contributor to his hometown newspaper, the Middletown Press and Journal.

(function(d, s, id) {var js, fjs = d.getElementsByTagName(s)[0];if (d.getElementById(id)) return;js = d.createElement(s); js.id = id;js.src = "//connect.facebook.net/en_US/all.js#xfbml=1";fjs.parentNode.insertBefore(js, fjs);}(document, 'script', 'facebook-jssdk'));

Latest Economy

- Ron Paul: "Country Should Panic Over Fed's Decision"

- The Fed's Balance At The End Of 2013: $4 Trillion

- Things Are Getting Worse: Median Household Income Has Fallen 4 Years In A Row

- Schiff Vs. Insana; Matter Vs. Anti-Matter

- Peter Schiff On CNBC - Talks Ban Corporate Profits Video

- Philip DeFranco Interviewed on Redistribution

- Peter Schiff Talks Rising Food Prices On Al Jazeera

- World's richest woman: "Drink less, work more"

People don't like to discuss it but it doesn't remove history. Clinton was involved in Mena airport drug trafficking for the CIA on the home leg of the Iran Contra scandal (Guns, Money, Drugs, Money Guns and loop). There are multiple witness testimony on Youtube. It takes about twenty hours to double check it all but Clinton had no problem looking the other way if anybody was murdered. However he didn't do it for money. Clinton's a lot smarter than that. Politics is a struggle for power, and the contest for high office like the White House is a struggle for world power. What kind of people do you think you would find engaged in struggles for world power?

"One of the most fascinating incidents, I think, was when Bill Clinton mentioned Carroll Quigley by name in his first inaugural address. Quigley was the only person Clinton thanked by name in that whole speech. It was Quigley who had spotted the potential of young Clinton when he was a student. Quigley learned that Clinton had, since he was only 15 years old, set his sights on the Presidency. When he got to know Clinton and saw that Clinton was completely bereft of morals and that there was no illegality he would not commit to achieve his goals, he knew that he had a man who was CFR material. It was Quigley who got him the Rhodes Scholarship to Oxford and put young Clinton under the guidance and control of the CFR." - Lake E. High, Jr., A True History Of The World In Our Time, 2004

Here's a list of suspicious deaths connected to the Clinton family:

whatreallyhappened.com/RANCHO/POLITICS/BODIES.html

Speaking of Rhodes, here's his philosophy in a nutshell:

"We must find new lands from which we can easily obtain raw materials and at the same time exploit the cheap slave labor that is available from the natives of the colonies. The colonies would also provide a dumping ground for the surplus goods produced in our factories." - Cecil Rhodes, English businessman, mining magnate, politician and the colonizer of the state of Rhodesia, which was named after him

This site contains copyrighted material the use of which in some cases has not been specifically authorized by the copyright owner. Such material is made available for the purposes of news reporting, education, research, comment, and criticism, which constitutes a 'fair use' of such copyrighted material in accordance with Title 17 U.S.C. Section 107. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner. It is our policy to respond to notices of alleged infringement that comply with the Digital Millennium Copyright Act (found at the U.S. Copyright Office) and other applicable intellectual property laws. It is our policy to remove material from public view that we believe in good faith to be copyrighted material that has been illegally copied and distributed by any of our members or users.

About Us - Disclaimer - Privacy Policy